How to Start a Proprietary Trading Firm

If you have a passion for trading and are eager to venture into the world of finance, establishing a proprietary trading firm could be the perfect opportunity for you. This guide will walk you through the essential steps and considerations on how to start a proprietary trading firm, ensuring you're equipped with the knowledge needed to transition from trader to entrepreneur.

Understanding Proprietary Trading

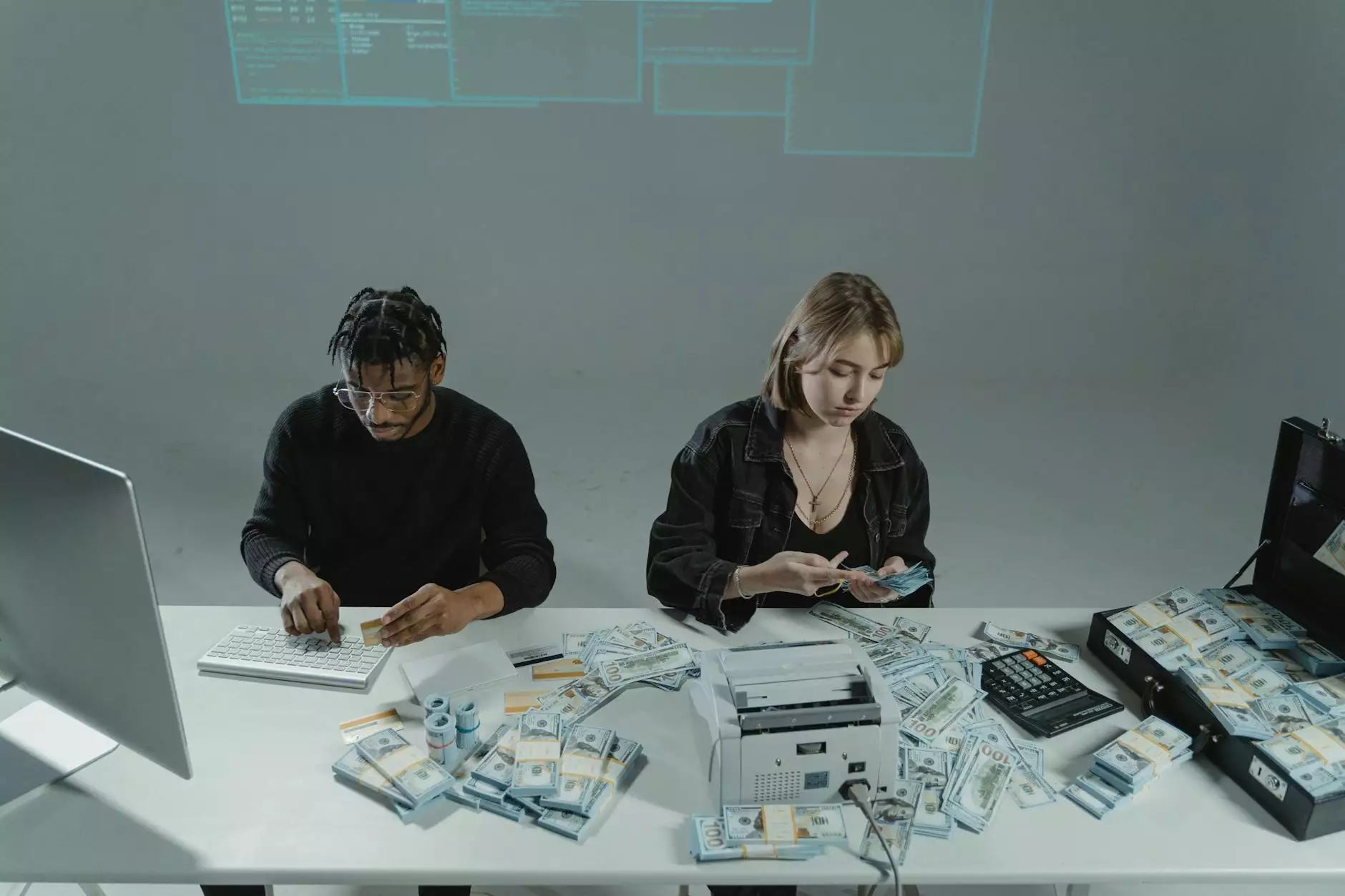

Proprietary trading firms, or “prop shops,” are companies that trade financial instruments, such as stocks, bonds, commodities, and derivatives, using their own capital, rather than clients’ funds. This presents a unique opportunity for traders, offering not just the potential for personal profit, but also the benefits of a collaborative and resource-rich work environment.

Step-by-Step Guide on How to Start a Proprietary Trading Firm

1. Develop a Solid Business Plan

Just like any business, starting a proprietary trading firm requires a well-thought-out business plan. Your business plan should include:

- Executive Summary: Overview of your firm, goals, and mission statement.

- Market Analysis: Research on the trading landscape, including competitors and potential market share.

- Operational Structure: Define the structure of your firm, including hierarchy and roles.

- Risk Management Strategies: Outline how you will manage financial risks inherent in trading.

- Funding Requirements: Specify capital needs, whether from personal investment, loans, or investors.

- Profit Sharing Model: Plan how profits will be distributed among traders and investors.

2. Understand Regulatory Compliance

Before you start trading, it is vital to understand the regulatory environment. Proprietary trading is subject to various regulations depending on your region.

- Register Your Firm: Depending on your location, you'll need to register your firm with local financial regulatory bodies.

- Licensing: Ensure you have the necessary licenses to operate a trading firm legally.

- Compliance Programs: Establish compliance with anti-money laundering (AML) and know your customer (KYC) regulations.

3. Choose a Trading Strategy

Your firm's success heavily relies on the trading strategies you employ. Common strategies include:

- Day Trading: Taking advantage of short-term price fluctuations.

- High-Frequency Trading (HFT): Utilizing algorithms to capitalize on small market inefficiencies.

- Arbitrage: Exploiting price differentials in markets.

- Long/Short Equity: Buying undervalued stocks and selling overvalued ones.

Each strategy comes with its risks and rewards, and it’s crucial to thoroughly research and possibly backtest your chosen methodologies before implementation.

4. Secure Funding

Financial capital is the lifeblood of any trading firm. You will need to secure substantial funding to start trading effectively. Here are some options:

- Personal Investment: Use your own savings or profits from trading to kickstart the firm.

- Angel Investors: Seek out individuals who are willing to invest in your vision in exchange for equity.

- Venture Capital: Approach venture capital firms that focus on financial services.

- Bank Loans: Explore traditional financing options, but be aware of the risks associated with debt.

5. Set Up Infrastructure and Technology

Having the right technological infrastructure is critical for a proprietary trading firm. Invest in:

- Trading Platforms: Choose platforms that best suit your trading strategies and provide reliable execution.

- Data Feeds: Obtain access to real-time data feeds for accurate market insights.

- Risk Management Tools: Implement software to monitor and manage risks at all times.

6. Assemble a Skilled Team

A successful proprietary trading firm is often built around a team of talented traders. When hiring, focus on candidates with a proven track record, complementary skills, and a robust understanding of market dynamics. Keys to a successful team include:

- Diverse Expertise: Broaden your trading capabilities by hiring traders with different strategies and insights.

- Cultural Fit: Ensure that new hires align with the firm’s culture and values, fostering collaboration.

- Continuous Learning: Encourage a culture of ongoing education to stay abreast of market trends and innovations.

7. Implement Robust Risk Management Practices

Risk management is a critical pillar of a successful trading firm. Establish clear risk parameters to protect your capital:

- Position Sizing: Determine the appropriate amount to invest based on the total capital available and the risk tolerance.

- Stop-Loss Orders: Use stop-loss orders to prevent excessive losses in volatile markets.

- Diversification: Avoid concentration risk by diversifying across different assets and strategies.

The Importance of Technology in Proprietary Trading

In today's fast-paced trading environment, technology plays a pivotal role. To remain competitive, your firm must leverage advancements like:

- Algorithmic Trading: Automate trades to optimize execution timing and efficiency.

- Machine Learning: Incorporate machine learning models to enhance prediction capabilities based on historical data.

- Blockchain Technology: Explore the use of blockchain for secure and transparent transactions.

Establish a Strong Trading Culture

Building a strong company culture that fosters innovation and risk-taking can be the differentiator between a successful proprietary trading firm and a failing one. Encourage an environment where:

- Feedback is Encouraged: Foster open discussions about strategies, mistakes, and successes.

- Risk-Taking is Rewarded: Allow team members to express their ideas and take calculated risks.

- Team Collaboration is Vital: Promote teamwork in strategy development, enhancing results through diverse perspectives.

Monitor Performance and Adapt to Market Changes

As a proprietary trading firm, continuous performance monitoring is essential. Utilize key performance indicators (KPIs) to measure your success:

- Return on Investment (ROI): Track the profitability relative to the investments made.

- Sharpe Ratio: Evaluate risk-adjusted performance.

- Win/Loss Ratio: Analyze your success in trades to identify strengths and weaknesses.

Finally, adjust your strategies according to market changes, ensuring your firm remains agile in a dynamic environment.

Conclusion

Starting a proprietary trading firm is a highly rewarding endeavor that requires careful planning, a clear understanding of the market, and a strong operational foundation. By diligently following these steps on how to start a proprietary trading firm and being responsive to both market conditions and the evolving trading landscape, you can build a firm equipped for success. Embrace your journey into proprietary trading with confidence and strategic foresight, and watch your institution flourish.